PAN se Aadhaar Link Nahi Kiya Toh Hoga Bada Nuksaan! Lagegi ₹1000 Penalty Aur ITR Mein Aayegi Problem – Jaldi Karein Ye Kaam

By Shani | Updated: 30 December 2025

PAN se Aadhaar Link Nahi Kiya Toh Ho Jao Savdhaan! 31 December 2025 Last Date, Warna PAN Ho Jayega Inactive

📌 Introduction

Agar aapke paas PAN Card hai aur abhi tak use Aadhaar Card se link nahi kiya, toh yeh khabar aapke liye bahut zaroori hai।

Income Tax Department ne clear kar diya hai ki 31 December 2025 ke baad bina Aadhaar-PAN linking ke PAN inactive ho sakta hai।

Iska seedha asar aapki ITR filing, refund, banking aur investment services par padega. Isliye agar abhi tak linking pending hai, toh turant complete karein.

⏰ PAN-Aadhaar Linking Last Date

👉 Last Date: 31 December 2025

👉 Penalty: ₹1000 (Non-Refundable)

👉 Applicable For: Jinhone PAN ko Aadhaar se link nahi kiya hai

📢 Note:

Jo PAN 1 October 2024 se pehle Aadhaar se banaya gaya hai, unke liye linking mandatory hai.

💸 PAN-Aadhaar Link Nahi Karne Par Kya Nuksaan Hoga?

Agar aap deadline miss kar dete ho, toh:

❌ PAN Inactive ho jayega

❌ ITR file nahi kar paoge

❌ Income Tax refund ruk jayega

❌ Bank / Mutual Fund / Share Market kaam band ho sakta hai

❌ High TDS/TCS kat sakta hai

❌ Form 15G / 15H reject ho sakta hai

❌ KYC related problems aayengi

💰 PAN-Aadhaar Linking Penalty

| Condition | Fee |

|---|---|

| Before deadline | ₹0 |

| After deadline | ₹1000 (One Time) |

🔹 Yeh fee non-refundable hoti hai

🔹 Payment e-Pay Tax ke through hota hai

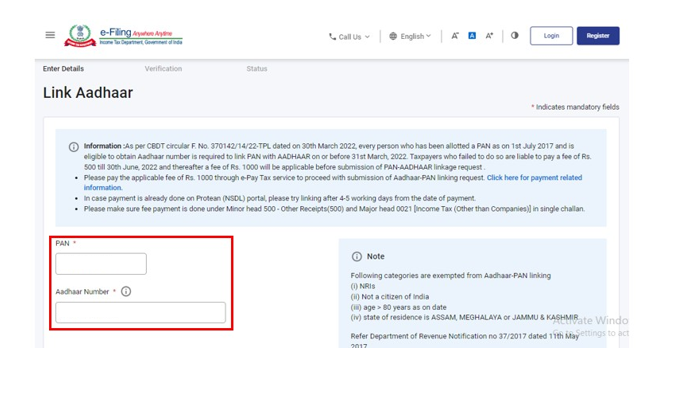

✅ PAN ko Aadhaar se Link Kaise Kare? (Step-by-Step)

🔹 Step 1:

Income Tax portal open karein

👉 https://www.incometax.gov.in/iec/foportal/

🔹 Step 2:

Homepage par “Link Aadhaar” par click karein

🔹 Step 3:

Enter karein:

- PAN Number

- Aadhaar Number

- Aadhaar ke according naam

🔹 Step 4:

OTP verify karein (Aadhaar linked mobile par)

🔹 Step 5:

Agar applicable ho to ₹1000 penalty pay karein

🔹 Step 6:

Submit karne ke baad confirmation message mil jayega

⏳ Status update hone mein 3–5 working days lag sakte hain

❓ FAQ – Frequently Asked Questions

🔹 Q1. PAN-Aadhaar linking ki last date kya hai?

👉 31 December 2025

🔹 Q2. Kya linking free hai?

👉 Nahi. Deadline ke baad ₹1000 penalty lagegi.

🔹 Q3. PAN inactive ho gaya toh kya hoga?

👉 Aap ITR file nahi kar paoge, refund nahi milega aur financial services block ho sakti hain.

🔹 Q4. Aadhaar Enrollment ID wale PAN ka kya rule hai?

👉 Aise PAN holders ko bhi 31 December 2025 tak linking karni hogi.

⚠️ Important Warning

⚠️ 31 December 2025 ke baad PAN inoperative ho jayega, jisse:

- Tax return file nahi hoga

- Refund atak jayega

- Bank & investment kaam ruk sakta hai

👉 Isliye aaj hi PAN-Aadhaar link karein aur future problems se bachein.

📌 Conclusion

PAN-Aadhaar linking ek mandatory process ban chuka hai. Agar aap apni financial life smooth rakhna chahte ho, toh bina delay ke aaj hi linking complete karein.

✅ Last Date: 31 December 2025

✅ Penalty: ₹1000

✅ Process: Online & Easy

- PAN Aadhaar Link Last Date 2025

- PAN Aadhaar Linking Penalty

- PAN Inactive Kya Hoga

- Aadhaar PAN Link Kaise Kare

- PAN Aadhaar News Hindi

- Income Tax PAN Aadhaar Update